Federal student loan borrowing limits

Federal Student Loan Borrowing Limits

Student loans are a popular way for students to finance their education in the United States. However, there are limits to how much students can borrow through federal student loan programs. Understanding these borrowing limits is crucial for students and their families to plan for the costs of higher education.

Types of Federal Student Loans

Before delving into the borrowing limits, it’s important to understand the types of federal student loans available. The two main types of federal student loans are Direct Subsidized Loans and Direct Unsubsidized Loans. Subsidized loans are based on financial need and the government pays the interest while the student is in school. Unsubsidized loans are not based on financial need, and students are responsible for paying the interest.

Borrowing Limits for Dependent Students

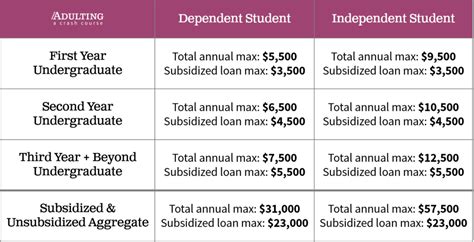

Dependent undergraduate students, meaning those who are financially dependent on their parents, have lower borrowing limits compared to independent students. The annual maximum limits for dependent undergraduates are as follows:

- First-year: $5,500 (maximum $3,500 subsidized)

- Second-year: $6,500 (maximum $4,500 subsidized)

- Third-year and beyond: $7,500 (maximum $5,500 subsidized)

- Aggregate limit: $31,000 (maximum $23,000 subsidized)

Borrowing Limits for Independent Students and Dependent Students (additional unsubsidized loan)

Independent undergraduate students and dependent students whose parents are unable to obtain Direct PLUS Loans have higher annual maximum limits, as they can also access additional unsubsidized loans. The annual maximum limits for independent students and dependent students with PLUS Loan denials are as follows:

- First-year: $9,500 (maximum $3,500 subsidized)

- Second-year: $10,500 (maximum $4,500 subsidized)

- Third-year and beyond: $12,500 (maximum $5,500 subsidized)

- Aggregate limit: $57,500 (maximum $23,000 subsidized)

Borrowing Limits for Graduate and Professional Students

For graduate and professional students, the borrowing limits are notably higher, reflecting the higher costs associated with advanced degrees. The annual maximum limits for graduate and professional students are as follows:

- Graduate or professional: $20,500 (unsubsidized only)

- Aggregate limit: $138,500 (includes undergraduate loans; maximum $65,500 subsidized)

Understanding the Implications

It’s essential for students and their families to understand the implications of these borrowing limits. Exceeding these limits may require students to seek alternative forms of financing or consider more cost-effective education options. Additionally, taking on excessive student loan debt can have long-term financial repercussions, affecting the ability to save, invest, or make major purchases after graduation.

Case Study: Impact of Borrowing Limits

For instance, consider a dependent undergraduate student who wishes to attend a private university with tuition costs exceeding the federal borrowing limits. This student and their family would need to explore additional financial aid options such as scholarships, grants, or private student loans, which often come with higher interest rates and less favorable repayment terms.

Statistics on Student Loan Debt

According to the Federal Reserve, outstanding student loan debt in the United States reached $1.7 trillion in 2021. The average student loan borrower owes around $30,000, with some borrowers owing significantly more. This highlights the potential risks associated with borrowing limits and the importance of making informed decisions when financing higher education.

Conclusion

Understanding federal student loan borrowing limits is essential for students and their families as they navigate the cost of higher education. By recognizing the limits and exploring alternative financing options, students can make more informed decisions and avoid excessive debt. It’s critical to consider the long-term financial implications of student loan borrowing and plan accordingly to achieve academic and financial success.

Q&A: Frequently Asked Questions

Q: Can students exceed the federal borrowing limits?

A: Students may seek additional financing options if they exceed the federal borrowing limits, but it’s important to carefully consider the implications of excessive debt.

Q: Are there options for students who need to finance education costs beyond the federal borrowing limits?

A: Students can explore scholarships, grants, and private student loans as alternative financing options, but they should be mindful of the associated terms and repayment obligations.

Q: How can students minimize the need for excessive borrowing?

A: Students can minimize the need for excessive borrowing by considering lower-cost education options, applying for scholarships and grants, and working part-time to offset expenses.

Q: What are the long-term effects of excessive student loan debt?

A: Excessive student loan debt can impact the ability to save, invest, or make major purchases after graduation, potentially hindering financial stability and long-term goals.